A Guide to Product Cost: Understanding What Makes the Cost of Product

Some industries are able to produce different products from the same raw material at different levels of processing. Knowing the cost of production will also help you decide whether to sell a product after one stage of processing or after two other stages. Calculating your product costs is a necessity if you are a manufacturer. Direct labor costs are not difficult to trace because the people working in the production line are the ones counting as cost. For every product in the market, there were some costs incurred to produce it.

When considering product costs in accounting, there are several vital points to bear in mind:

For example, if a carpenter makes the chair, the direct labor cost would include their wages and benefits. By considering these key points, businesses can gain valuable insights into their financial performance and make informed decisions about product cost accounting. You may need to buy state-of-the-art equipment for your developers and other team members. When it comes to pricing, many stakeholders have a say in how much a customer should pay for a product.

The Consequences Of Overcosting – Why It Can Be Harmful To A Business

It is a problem because they don’t have the right product costing strategy. This post will explain why manufacturing managers should worry about product overcosting or undercosting. Establishing goals for cost reduction, such as aiming to reduce spending by a particular percentage year over year, can also be beneficial in helping companies stay on track financially. Additionally, taking advantage of economies of scale can help reduce production costs.

Resources

Operating a small business can come with lots of exciting opportunities. You have goals to provide the best possible product or service to your customers. If producing one unit is higher compared to your competitors, then you cannot sell at the same price. But this does not reduce your labor costs because both shifts will be a cost of production.

- Research suppliers and compare prices to get the best deal on each item.

- Production costs can include a variety of expenses, such as labor, raw materials, consumable manufacturing supplies, and general overhead.

- Will you hire a fulfillment house, or will you transport your products yourself?

- Production cost is also known as factory cost and cost of goods manufactured.

Product Cost: Understanding What Makes the Cost of Product (And How to Manage It)

While personal finance can be daunting, the stakes are even higher when it comes to running a successful business. Without a solid understanding of where your expenses are going, you risk losing money and valuable resources. A well-designed manufacturing process can avoid overproduction and excess storage costs.

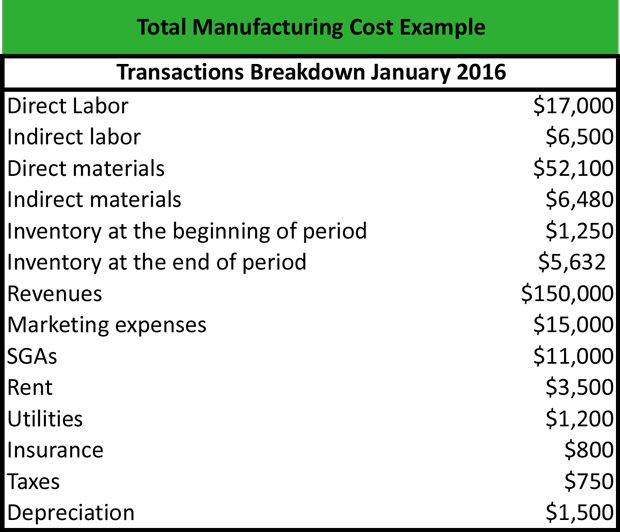

This system helps companies better understand their production process and identify areas where they can reduce costs to improve their bottom line. There are several costing systems that differ in how the overhead allocation is done. First, you have to decide which costs you will treat as direct and indirect costs. Secondly, you can decide on having one or multiple cost pools with different cost allocation bases. Indirect material costs – in the course of your manufacturing, there are costs which you will incur yet they don’t go directly into the finished products. Profitability depends on various factors, including revenue and operational efficiency.

For example, John & Muller company manufactures 500 units of product X in year 2022. Out of these 500 units manufactured, the company sells only 300 units during the year 2022 and 200 unsold units remain in ending inventory. The direct materials, direct labor and manufacturing overhead costs incurred to manufacture these 500 units would be initially recorded as inventory (i.e., an asset). The cost of 300 units would be transferred to cost of goods sold during the year 2022 which would appear on the income statement of 2022. The remaining inventory of 200 units would not be transferred to cost of good sold in 2022 but would be listed as current asset in the company’s year-end balance sheet.

It enables a company to make informed decisions, stay competitive, and increase profitability. A company must make sure it is charging enough to cover its costs and make a profit. If a company sets its prices too low, it cannot cover its costs and may go out of business. Finally, assessing business processes regularly and improving efficiency is essential for controlling costs while ensuring proper functionality. Regularly evaluating vendors and comparing prices for different materials can also help companies save money. This can include wages, benefits, and any other expenses related to the employees who have the product.

Put simply, understanding the costs of developing a product, feature, or update helps you make more informed decisions throughout the product lifecycle. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. For example, you could opt for allocating overhead to sectors such as inspections, material handling, and purchasing.

LogRocket identifies friction points in the user experience so you can make informed decisions about product and design changes that must happen to hit your goals. With LogRocket, you can understand the scope of the issues affecting your product and prioritize the changes that need to be made. LogRocket simplifies workflows by allowing customizing invoice title Engineering, Product, UX, and Design teams to work from the same data as you, eliminating any confusion about what needs to be done. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path.